Table of Contents

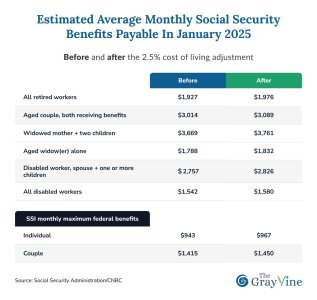

- What the 2025 Earnings Limit Means for COLA Calculations in Social ...

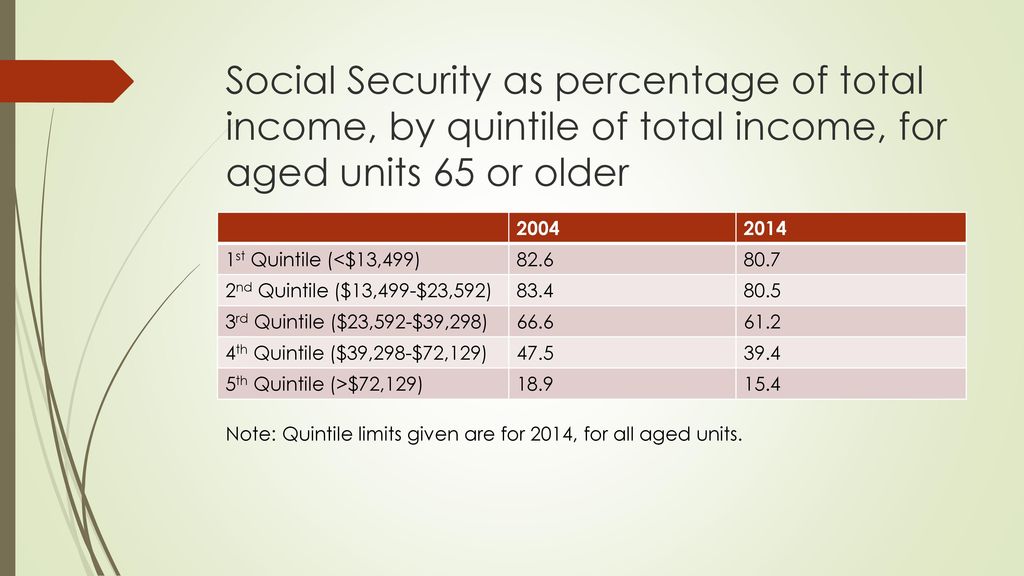

- Sources of Income for those Aged 65 or Older, - ppt download

- 2025 Social Security Increase: What You MUST Know! 💵📈" 2025 social ...

- Social Security Administration Proposes 2 Much-Needed Changes, But ...

- Social Security Checks To Get Big Increase In 2019 | Social security ...

- IRS Announces New Tax Brackets for 2025 and Social Security COLA – How ...

- 2025 Social Security COLA Estimate - Latest Update - YouTube

- 2025 Estimated COLA - Social Security Increase! How much will it be ...

- 2025 Social Security check sizes to be revealed soon—what you need to ...

- Everything is going to change forever on Social Security benefits in ...

What is Publication 15-A?

Key Updates in the 2025 Publication 15-A

Employer Tax Obligations

Employers have several tax obligations that they must fulfill, including: Withholding federal income tax: Employers must withhold federal income tax from employee wages and report the amounts withheld on Form W-2. Paying Social Security and Medicare taxes: Employers must pay Social Security and Medicare taxes on behalf of their employees. Reporting employment taxes: Employers must report employment taxes on Form 941 and deposit the taxes on a timely basis.

Accessing the 2025 Publication 15-A

The 2025 Publication 15-A is available on the IRS website in PDF format. Employers can download the guide and use it as a reference to ensure compliance with tax laws and regulations. The publication is also available in print format, and employers can order copies from the IRS website. The PDF 2025 Publication 15-A is an essential resource for employers and tax professionals. The guide provides comprehensive information on employer taxation, including updates on withholding thresholds, tax tables, and fringe benefits. By understanding the key aspects of the publication, employers can ensure compliance with tax laws and regulations, avoiding costly penalties and fines. As the tax landscape continues to evolve, it is crucial for employers to stay informed and up-to-date on the latest developments.For more information on the 2025 Publication 15-A, visit the Internal Revenue Service website. Employers can also consult with tax professionals or seek guidance from the IRS to ensure compliance with tax laws and regulations.